When an investor buys a corporate bond, the ________ the bond is a loan to the corporation

A) interest on B) dividend payment on

C) coupon payment on D) face value of

D

You might also like to view...

When using the income approach to measure GDP at market prices, in addition to summing all factor incomes it is necessary to ________

A. subtract depreciation because profit is not reported as net profit B. add depreciation because capital depreciates when goods are manu-factured C. add indirect taxes less subsidies to convert aggregate income from factor cost to market prices D. add a statistical discrepancy which is the sum of depreciation and in-direct taxes less subsidies

Which of the following did the 1986 Tax Reform Act not intended to do?

a. lower marginal tax rates b. broaden the tax base c. keep average tax rates the same d. reduce the bias towards saving

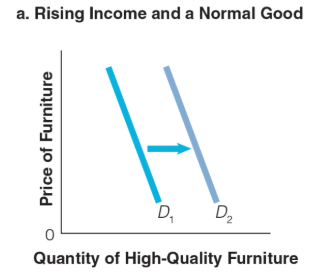

Which of the following would cause a shift of the demand curve to the right?

a. The price of a complement increases.

b. The number of buyers in a market decreases.

c. Tastes change against a good.

d. Future price increase is expected.

Figure 20-1

A. A B. B C. C D. D