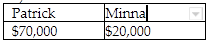

Yellow Trust must distribute 33% of its income annually to Patrick. In addition, the trustee in its discretion may distribute additional income to Minna or Patrick. In the current year, the trust has net accounting income and distributable net income of $150,000, none from tax-exempt sources. The trust makes a $50,000 mandatory distribution to Patrick and a discretionary distribution of $20,000

each to Patrick and Minna. What amounts of income do Patrick and Minna report?

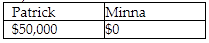

A)

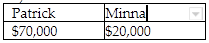

B)

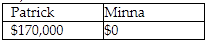

C)

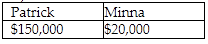

D)

B)

You might also like to view...

Which of the following is an employee characteristic of relevance in path-goal theory?

A. Position power B. Work satisfaction C. Need for achievement D. Task awareness E. Extroversion

Which of the following statements about employees is not true?

A) They may be considered "internal customers." B) They typically will not give company feedback on intranet sites. C) Intranets offer ways to engage them online. D) Online surveys may help company leaders better meet their needs. E) They may offer valuable feedback to company leaders.

Productions costs are transferred from one Work-in-Process Inventory account to the next and eventually to ________

A) Manufacturing Overhead B) Sales Revenue C) Finished Goods Inventory D) Accounts Payable

Wes breached a contract he had with Blake. In addition to other remedies available, Blake may be able to recover commercially reasonable expenses incurred as a result of the breach. These expenses are:

A) incidental damages. B) punitive damages. C) liquidated damages. D) extraordinary damages.