Higher personal income taxes

A) increase aggregate demand.

B) increase disposable income.

C) decrease aggregate demand.

D) both B and C

Answer: C

You might also like to view...

During the Civil War (1861–1865), hyperinflation occurred in

(a) the North. (b) the South. (c) both the North and South. (d) neither the North nor the South.

Which event in business regulatory history permitted government intervention in industry affairs?

(a) The case of Munn v Illinois (1877) (b) The Sherman Act of 1890 (c) The case of Nebbia v New York (1934) (d) The creation of the Interstate Commerce Commission via the Interstate Commerce Act of 1887

The required reserves of a bank are determined by multiplying the bank's checkable deposits by the required reserve ratio

a. True b. False Indicate whether the statement is true or false

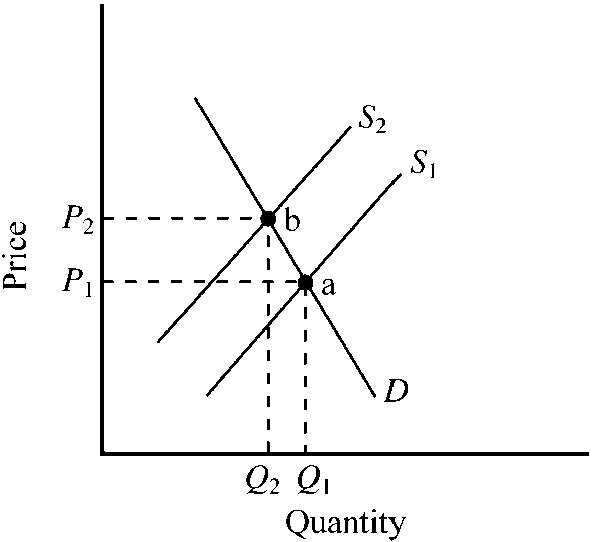

Figure 5-2

illustrates the market for a product that generates an external cost. S1 is the private market supply curve, while S2 is the supply curve including the external cost. Which of the following is true?

a.

Relative to economic efficiency, output of the good will be too large and the price too low.

b.

Relative to economic efficiency, output of the good will be too large and the price too high.

c.

Relative to economic efficiency, output of the good will be too small and the price too low.

d.

Relative to economic efficiency, output of the good will be too small and the price too high.