Consider the following two investments. One is a risk-free investment with a $100 return. The other investment pays $2,000 20% of the time and a $375 loss the rest of the time. Based on this information, answer the following: (i) Compute the expected returns and standard deviations on these two investments individually. (ii) Compute the value at risk for each investment. (iii) Which investment will risk-averse investors prefer, if either? Which investment will risk- neutral investors prefer, if either?

What will be an ideal response?

(i) The expected rate of return is $100 for the risk-free investment. The risk-free investment has a standard deviation of zero because the return is certain. For the risky investment:

Expected return = 0.2($2,000) + 0.8(-$375) = $100

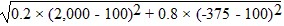

Standard Deviation =  2 =

2 =  = 950

= 950

(ii) The value at risk for the risk-free investment is $100 because it pays a certain return. The value of risk for the risky investment is -$375, this is the maximum amount the investor can lose.

(iii) The risk-averse investor will prefer the risk-free investment. The risk-neutral investor will not have a preference between the two investments because they pay the same expected return.

You might also like to view...

A bank has reserves of $50, deposits of $100, loans of $20, and government securities of $30. Assume the desired reserve ratio is 20 percent

a. What are the bank's assets and what are its liabilities? b. How much does the bank have in excess reserves? c. What can the bank do with its excess reserves that will affect the quantity of money?

Property taxes are a major source of revenue for

A) state and local governments. B) the federal governments. C) the federal, state, and local governments. D) firms wanting to relocate their operations. E) consumers.

Since World War II, the likelihood that foreign markets would gain importance to average exporters as a source of profits has

A) remained constant. B) increased. C) decreased. D) fluctuated widely with no clear trend. E) increased slightly before dropping off.

Suppose that the federal budget is balanced when GDP is at potential GDP. If equilibrium GDP falls below potential

A) this will result in a current budget deficit. B) the cyclically adjusted budget will be balanced. C) government transfer payments will be rising and tax receipts will be falling. D) All of the above are correct.