Which statement is true?

A. The U.S. is both the world's leading creditor nation and the leading debtor nation.

B. The U.S. is neither the world's leading creditor nation nor the world's leading debtor nation.

C. The U.S. is the world's leading creditor nation and not the world's leading debtor nation.

D. The U.S. is the world's leading debtor nation and not the world's leading creditor nation.

D. The U.S. is the world's leading debtor nation and not the world's leading creditor nation.

You might also like to view...

Yvette buys and sells real estate. Two weeks ago, she paid $300,000 for a house on Pine Street, intending to spend $50,000 on repairs and then sell the house for $400,000 . Last week, the city government announced a plan to build a new landfill on Pine Street just down the street from the house Yvette purchased. As a result of the city's announced plan, Yvette is weighing two alternatives: She

can go ahead with the $50,000 in repairs and then sell the house for $290,000 . or she can forgo the repairs and sell the house as it is for $250,000 . She should a. keep the house and live in it. b. go ahead with the $50,000 in repairs and sell the house for $290,000. c. forgo the repairs and sell the house as it is for $250,000. d. move the house from Pine Street to a more desirable location, regardless of the cost of doing so.

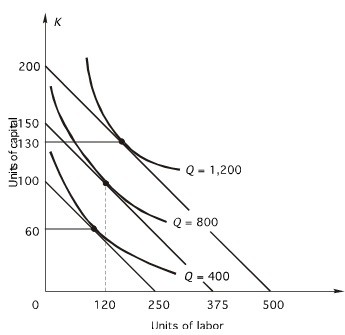

Refer to the following figure. The price of capital is $50 per unit:  How many units of capital should the firm use to produce 800 units of output at least cost?

How many units of capital should the firm use to produce 800 units of output at least cost?

A. 98 B. 120 C. 110 D. 102 E. 108

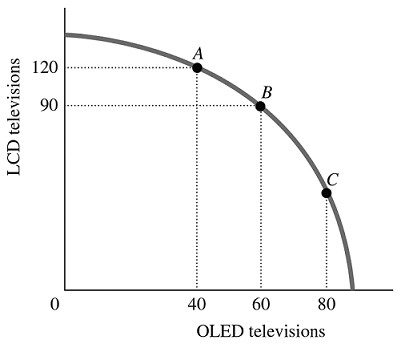

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

A. 120 LCD TVs that must be forgone to produce 20 additional OLED TVs. B. 30 LCD TVs that must be forgone to produce 40 additional OLED TVs. C. 20 OLED TVs that must be forgone to produce 30 additional LCD TVs. D. 40 OLED TVs that must be forgone to produce 120 additional LCD TVs.

A commercial bank has checkable-deposit liabilities of $500,000, reserves of $150,000, and a required reserve ratio of 20 percent. The amount by which a single commercial bank and the amount by which the banking system can increase loans are respectively:

A. $30,000 and $150,000 B. $50,000 and $250,000 C. $50,000 and $500,000 D. $100,000 and $500,000