A perfectly competitive firm:

a. cannot choose its own price.

b. can increase the price of a good in order to increase its revenue

c. can decrease the price of a good in order to increase its share in the market.

d. cannot choose to produce the quantity it wants.

a

You might also like to view...

Refer to Figure 12-5. If the market price is $20, what is the firm's profit-maximizing output?

A) 750 units B) 1,100 units C) 1,350 units D) 1,800 units

Taxes distort economic behavior because they

A) change the composition of income and spending. B) cause deviations in economic behavior from the efficient, free-market outcome. C) change the balance between private and public expenditures. D) change the composition of consumption, investment, government spending, and net exports.

If the intended aim of the price floor set in the graph shown was a net increase in the well-being of producers, then positive analysis would have us consider:

If the intended aim of the price floor set in the graph shown was a net increase in the well-being of producers, then positive analysis would have us consider:

A. whether the surplus transferred from consumers to producers is larger than the consumer surplus lost to deadweight loss. B. whether the producer surplus lost due to lower prices is greater than the producer surplus lost due to fewer transactions taking place. C. whether the producer surplus lost to deadweight loss is greater than the producer surplus gained from a higher price. D. whether the surplus transferred from producers to consumers is larger than the consumer surplus lost to deadweight loss.

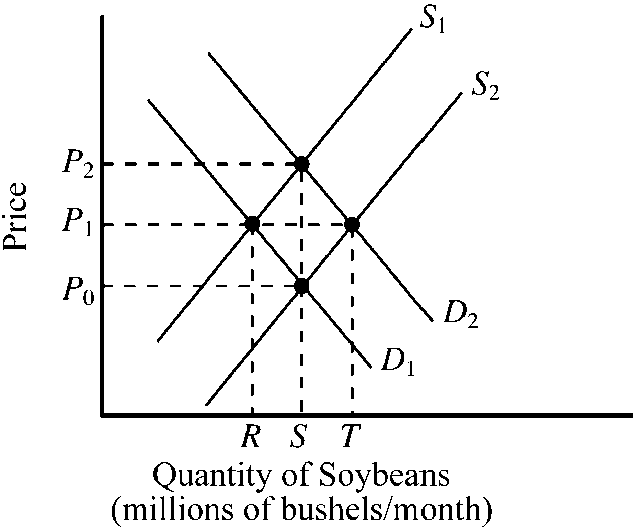

Figure 3-8

In , if the initial demand and supply for soybeans were D1 and S1, how would a decrease in the cost of producing soybeans affect the market for soybeans?

a.

Demand would increase to D2, price would increase to P2, and the quantity would increase to S.

b.

Supply would increase to S2, price would decrease to P0, and the quantity would increase to S.

c.

Both demand and supply would increase so the price would remain at P1, but the quantity would increase to T.

d.

None of the above would occur.