Assume payroll for Kicker Sound Systems for the month of January was $150,000 and the following withholdings, fringe benefits, and payroll taxes apply: Federal and state income taxes withheld$38,000Health insurance premiums (Blue Cross) paid by employer12,000Contribution to retirement plan (Fidelity) paid by employer15,000FICA tax rate (Social Security and Medicare)7.65%Federal and state unemployment tax rate3.80%Assume that Kicker has paid none of the withholdings or payroll taxes by the end of January (record them as payables) and that no employee's cumulative wages exceed the relevant wage bases. Required: 1. Record the employee salary expense, withholdings, and salaries payable.2. Record the employer-provided fringe benefits.3. Record the employer payroll taxes.

What will be an ideal response?

Requirement 1

| January 31 | ? | ? |

| Salaries Expense | 150,000 | ? |

| Income Tax Payable | ? | 38,000 |

| FICA Tax Payable | ? | 11,475 |

| Salaries Payable (to balance) | ? | 100,525 |

Requirement 2

| January 31 | ? | ? |

| Salaries Expense (fringe benefits) | 27,000 | ? |

| Payable to Blue Cross | ? | 12,000 |

| Payable to Fidelity | ? | 15,000 |

Requirement 3

| January 31 | ? | ? |

| Payroll Tax Expense (total) | 17,175 | ? |

| FICA Tax Payable | ? | 11,475 |

| Unemployment Tax Payable | ? | 5,700 |

FICA Tax Payable: $150,000 × 0.0765 = $11,475

Unemployment Tax Payable: $150,000 × 0.038 = $5,700

Business

You might also like to view...

Project scope management involves

A) developing a project charter. B) collecting requirements. C) defining activities. D) acquiring a project team.

Business

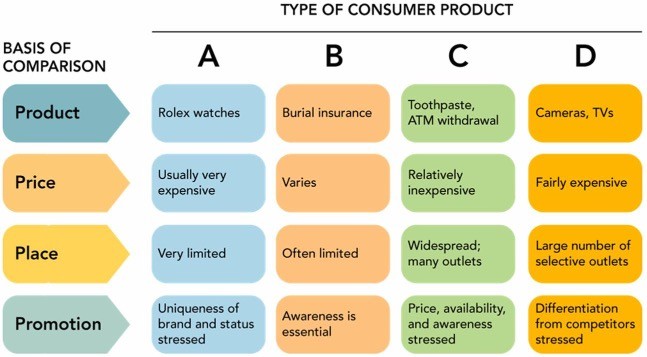

Figure 9-2According to Figure 9-2 above, column B would represent which type of product?

Figure 9-2According to Figure 9-2 above, column B would represent which type of product?

A. unsought B. prestige C. shopping D. specialty E. convenience

Business

____ is a disk storage technique that improves performance and fault tolerance

a. DIR b. RAID c. PAID d. PAIR

Business

Identify and discuss five recommendations for companies that wish to grow

What will be an ideal response?

Business