Discuss whether mandatory AIDS testing of prison inmates without having probable cause or a warrant violates the Fourth Amendment

What will be an ideal response?

In Dunn v. White, the issue of mandatory AIDS testing was raised by a prison inmate. The inmate, who was being disciplined for refusing to submit to AIDS testing, claimed that the government was violating his Fourth Amendment rights by compelling

him to submit to an AIDS test without having probable cause or a warrant. The

Tenth Circuit Court of Appeals found that such a test is a search under the Fourth

Amendment. However, because prison officials have the responsibility of making placement, segregation, and treatment decisions concerning inmates, and because

they must consider the health and safety of all the inmates and employees of the

institution, mandatory AIDS testing is reasonable and can be conducted without

first obtaining a warrant and without probable cause.

You might also like to view...

In managing their international marketing activities, most companies first ________

A) organize an import department B) create an international division C) initiate foreign direct investment D) form a domestic subsidiary E) organize an export department

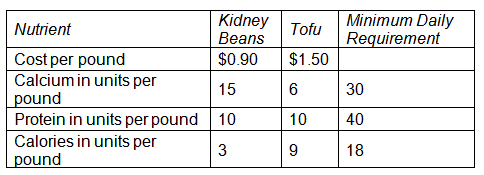

A school is trying to determine a nutritional diet to feed its students. The school would like to offer some combination of milk and beans. The school’s objective is to minimize cost, subject to meeting the minimum nutritional requirements of protein, calcium, and calories. The cost and nutritional content of each food, along with the minimum nutritional requirements are shown here.

At the optimum solution, what is the cost of tofu in the diet?

a. $0.95

b. $1.22

c. $2.65

d. $1.50

If you obtain an FHA or VA loan you will make additional payments each month to cover your home insurance and property taxes that will be placed in an account called a(n)

A) insurance account. B) appraisal account. C) escrow account. D) default prevention account.

Assuming a 21% marginal tax rate, compute the after-tax cost of the following business expenses.a. $12,300 business meals. b. $42,000 rent on factory equipment. c. $8,050 business entertainment.

What will be an ideal response?