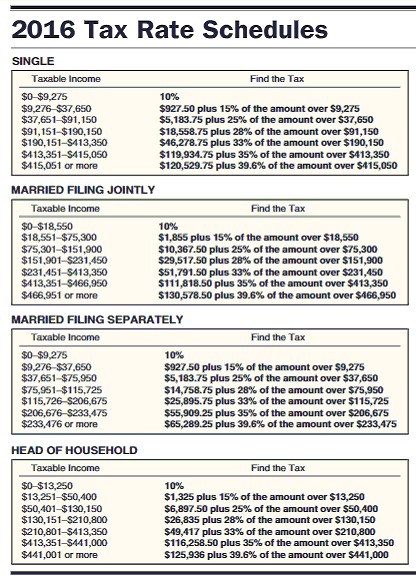

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 formarried taxpayers filing separately, and $9300 for head of household and the tax rate schedule. Brian Moss had wages of $80,745, dividends of $374, interest of $684, and adjustments to income of $1,066 last year. He had deductions of $878 for state income tax, $452 for city income tax, $988 for property tax, $7,336 in mortgage interest, and $182 in contributions. He claims three exemptions and files as head of household.

Brian Moss had wages of $80,745, dividends of $374, interest of $684, and adjustments to income of $1,066 last year. He had deductions of $878 for state income tax, $452 for city income tax, $988 for property tax, $7,336 in mortgage interest, and $182 in contributions. He claims three exemptions and files as head of household.

A. $8,985.25

B. $8,362.65

C. $10,051.75

D. $3,387.75

Answer: A

Mathematics

You might also like to view...

Solve the problem.After t seconds, the height s of a projectile launched upward with an initial velocity of 3200 feet per second is given by s = 3200t - 16t2. What is the height of the projectile after 116 seconds?

A. 373,056 feet B. 155,904 feet C. 586,496 feet D. 369,344 feet

Mathematics

Write as a percent. 0.43

A. 0.043% B. 4.3% C. 430% D. 43%

Mathematics

Divide.29.76 ÷ -0.16

A. -1860 B. -18.6 C. -186 D. 29.76

Mathematics

Perform the division. Write the answer with positive exponents.

A. 6x + 2

B. 6x + 2 +

C. 6x - 10x5 +

D. 13x + 2

Mathematics