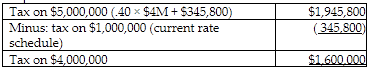

In 2018, Letty makes taxable gifts totaling $4 million. Her only other taxable gifts amount to $1 million, all of which were made in 2012. What is Letty's 2018 gift tax liability before the unified credit?

A) $2,220,800

B) $1,875,000

C) $1,840,800

D) $1,600,000

D) $1,600,000

Business

You might also like to view...

Cash paid for preferred stock dividends should be shown on the statement of cash flows under

a. investing activities b. financing activities c. noncash investing and financing activities d. operating activities

Business

Auditing is a type of attest service.

Answer the following statement true (T) or false (F)

Business

Jill, a Product Manager for Nike, is responsible for evaluating the viability of a radically new product. How should she estimate demand?

What will be an ideal response?

Business

The price/earnings (P/E) ratio is a measure of investors' confidence in a company's future

Indicate whether the statement is true or false

Business