There are 1,000 families in a neighborhood that is affected by noise pollution from a local factory. The noise level is within legal limits, but could be reduced further if the company spent $5,000 on technological improvements. The company agrees to make these improvements if the affected families contribute the $5,000. A committee starts to collect donations to pay for the improvements. Which of the following is most likely to occur?

A. Because there are relatively few families involved and the individual contribution is so small, all families will voluntarily contribute.

B. Even if the families raise the $5,000, the firm will not reduce its noise pollution because it is within legal limits.

C. Because each individual contribution is so small and individuals will benefit from the reduction in noise whether they contribute or not, most people will not contribute and the firm will not make the improvements.

D. The courts will force the firm to spend the $5,000 regardless of whether or not the families contribute the money.

Answer: C

You might also like to view...

A voluntary export restraint is an agreement negotiated between two countries that places a numerical limit on the quantity of a good that can be imported by one country from the other country

Indicate whether the statement is true or false

According to the graph shown, the equilibrium price is ______ and equilibrium quantity is ____.

According to the graph shown, the equilibrium price is ______ and equilibrium quantity is ____.

A. $5; 30

B. $10; 20

C. $20; 10

D. $15; 30

In a certain year, the aggregate amount demanded at the existing price level consists of $100 billion of consumption, $40 billion of investment, $10 billion of net exports, and $20 billion of government purchases. Full-employment GDP is $120 billion. To

obtain price-level stability under these conditions, the government should: A. increase tax rates and/or reduce government spending. B. discourage personal saving by reducing the interest rate on government bonds. C. increase government expenditures. D. encourage private investment by reducing corporate income taxes.

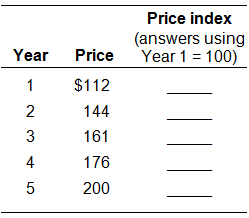

The following table shows the price of a specific stereo receiver for a five-year period. Using Year 1 as the base year, calculate the price index for each year