Which of the following is NOT part of an economy's financial markets?

A. The stock market

B. Banks and brokerage firms

C. Political action committees

D. The residential mortgage market

Answer: C

You might also like to view...

Ricardian equivalence argues that when the government

A) increases taxes and raises its deficit, consumers anticipate that they will face higher taxes later to pay for the resulting government debt, thus people will raise their own private saving to offset the fall in government saving. B) cuts taxes and decreases its deficit, consumers anticipate that they will face higher taxes later to pay for the resulting government debt, thus people will raise their own private saving to offset the fall in government saving. C) cuts taxes and raises its surplus, consumers anticipate that they will face higher taxes later to pay for the resulting government debt, thus people will raise their own private saving to offset the fall in government saving. D) cuts taxes and raises its deficit, consumers anticipate that they will face lower taxes later to pay for the resulting government debt, thus people will raise their own private saving to offset the fall in government saving. E) cuts taxes and raises its deficit, consumers anticipate that they will face higher taxes later to pay for the resulting government debt, thus people will raise their own private saving to offset the fall in government saving.

The amount of government spending on education per public school student has ________ since 1960, and the achievement level of students has generally ________ since that time

A) increased; increased B) decreased; decreased C) increased; decreased D) decreased; increased

Compared to the perfectly competitive outcome, monopolistically competitive markets will result in:

A. a wider variety of products and higher prices. B. less product variety and higher prices. C. a wider variety of products and lower prices. D. less product variety and lower prices.

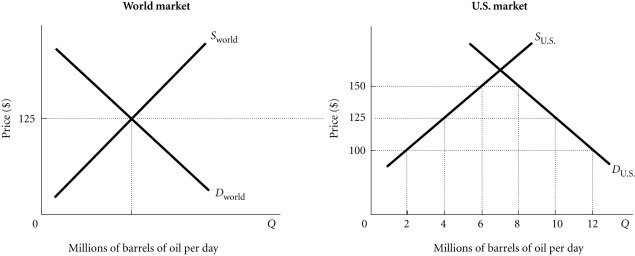

Refer to the information provided in Figure 4.4 below to answer the question(s) that follow. Figure 4.4Refer to Figure 4.4. If the United States levies no tariffs on imported oil, which of the following would occur?

Figure 4.4Refer to Figure 4.4. If the United States levies no tariffs on imported oil, which of the following would occur?

A. The price of oil in the United States would fall to $100 per barrel, and the United States would import 10 million barrels of oil per day. B. The price of oil in the United States would be $150 per barrel, and the United States would import 2 million barrels of oil per day. C. The price of oil in the United States would be $125 per barrel, and the United States would import 6 million barrels of oil per day. D. The price of oil in the United States after the U.S. government eliminated all tariffs on imported oil cannot be determined from this information.