On January 1, 20X8, Putter Corporation acquired 40 percent of the voting shares of Shank Company for $65,000. Shank reported net income of $45,000 and paid dividends of $10,000 in 20X8. Putter reported operating income of $50,000 for the year. There is 80 percent exemption of intercompany dividends and the effective tax rate is 35 percent. Assume that the equity method is being used.For a subsidiary to be eligible to be included in a consolidated tax return, at least ________ of its stock must be held by the parent company or another company included in the consolidated return.

A. 40 percent

B. 80 percent

C. 50 percent

D. 75 percent

Answer: B

You might also like to view...

Which of the following about disruptive innovations is FALSE?

a. Disruptive innovations typically appeal to customers at the lower end of the market. b. Disruptive innovations help a company to target demanding, high-end customers. c. Many established companies often underestimate the competitive threat disruptive innovations pose. d. Disruptive innovations can be found in product, process, and business strategy innovations. e. a and d are both FALSE

Sweet Company's outstanding stock consists of 1400 shares of cumulative 6% preferred stock with a $100 par value and 10,400 shares of common stock with a $10 par value. During the first three years of operation, the corporation declared and paid the following total cash dividends. Dividend Declaredyear 1$2400?year 2$6400?year 3$34,000?The amount of dividends paid to preferred and common shareholders in year 3 is:

A. $16,400 preferred; $17,600 common. B. $34,000 preferred; $0 common. C. $8400 preferred; $25,600 common. D. $0 preferred; $34,000 common. E. $25,200 preferred; $8800 common.

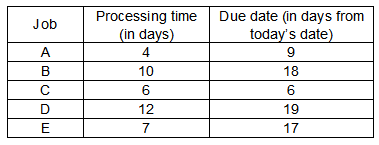

Determine the longest processing time (LPT) sequence for the jobs listed in the following table.

a. A-B-C-D-E

b. D-B-C-A-E

c. D-B-E-C-A

d. A-D-C-B-E

The objective/task method of setting budgets is also known as the budget-buildup method.

Answer the following statement true (T) or false (F)