Which of the following statements about the provision of public goods is true?

A. The optimal level of a public good occurs when all taxpayers receive some of the good.

B. If the marginal benefit of a public good exceeds its marginal cost, more should be provided.

C. The total benefit of a public good should equal its total cost.

D. The government should always provide public goods.

Answer: B

You might also like to view...

The above table shows answers given by people interviewed in a government survey of households. Which individual or individuals are considered marginally attached?

A) A B) B, C, and D C) A and D D) D

By refusing to be time inconsistent, a central bank is ________ its reputation and ________ "policy credibility."

A) harming, losing B) harming, gaining C) investing in, losing D) investing in, gaining

When private benefits are less than social benefits, it means that:

A. positive externalities are present in the market. B. positive externalities are not present in the market. C. negative externalities are not present in the market. D. no externality of any kind is present in the market.

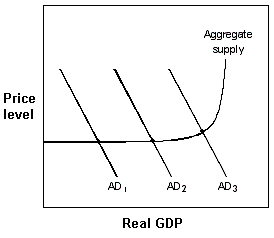

Exhibit 20-4 Aggregate demand and supply model

?

A. Lower the legal reserve requirement. B. Lower the discount rate. C. Lower the federal funds rate. D. Sell government securities.