The amount of investment demand at each interest rate suddenly falls. If the Fed holds to an unchanged money supply target, the change in GDP is __________ if it had held to an unchanged interest rate target

A) greater than

B) less than

C) the same as

B

You might also like to view...

All of the following are true about foreign direct investment (FDI) and portfolio investment EXCEPT

A) increases in the flow of portfolio investments increase the likelihood of financial crisis. B) both portfolio investments and FDI are the same in that they both give their holders a claim on the future output of the foreign economy. C) FDI is relatively illiquid compared to portfolio investment. D) portfolio investments have been on the decline in recent years (or decades). E) FDI investors must be willing to go through many ups and downs in order to benefit from their long-term investments.

A consumer optimum is characterized by

A) the marginal rate of substitution of one good divided by its price equal to the marginal rate of substitution of the other good divided by its price. B) the marginal rate of substitution equal to unity. C) the marginal rate of substitution equal to the ratio of the prices of the two goods. D) the marginal rate of substitution divided by the price ratio of the two goods equal to the income of the consumer.

Describe the economic effects of the U.S. price supports and import quotas for sugar

What will be an ideal response?

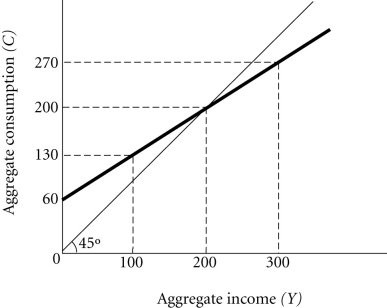

Refer to the information provided in Figure 23.3 below to answer the question(s) that follow. Figure 23.3Refer to Figure 23.3. In this economy, aggregate saving will be zero if income is

Figure 23.3Refer to Figure 23.3. In this economy, aggregate saving will be zero if income is

A. $100 billion. B. $200 billion. C. $300 billion. D. $400 billion.