What is a prior-period adjustment? How and when is a prior-period adjustment recorded?

What will be an ideal response

A prior-period adjustment is a correction to retained earnings for an error in an earlier period. A prior-period adjustment is corrected by adjusting the beginning balance in the Retained Earnings account in the period when the error is discovered.

You might also like to view...

Which of the following is a tax borne by the employer but not the employee?

a. State income tax b. FUTA tax c. Medicare tax d. Social security tax

With privatization, all of these may occur, except

A. assets are transferred from the public sector to the private sector. B. state activities are moved into private management through contracts. C. business loses its right to hire new employees. D. government control of business management may be increased.

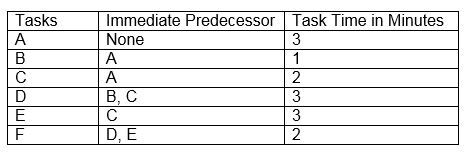

An assembly line to be balanced has six tasks in precedence. The task times are shown in the following table. Based on demand forecasts, the output rate has to be 160 units per day. The line operates 8 hr a day. Calculate the desired cycle time C.

A. 3 min/unit

B. 4 min/unit

C. 5 min/unit

D. 6 min/unit

The difference between an inter vivos gift and a gift causa mortis is that the inter vivos gift is made during the donor's lifetime and a gift causa mortis is a gift is made after the donor's lifetime by the donor's estate

a. True b. False Indicate whether the statement is true or false