Offer a skeptical perspective on the long-term economics of the recent increase in trend rate productivity

Please provide the best answer for the statement.

The doubts that the skeptics raise are whether the increases in productivity and economic growth can be sustained over a long period of time. Skeptics question whether the current trend is a short-term economic expansion rather than a long-term structural change in the economy. Economic boom can also create shortages and contribute to inflationary pressure in the economy if the productivity increases do not keep pace with the expanding demands on the economy. The excessive demand can increase the general level of prices. The response of the Federal Reserve to increasing inflationary pressure is to raise the target for short-term interest rates. This action can reduce investment spending and slow economic growth.

You might also like to view...

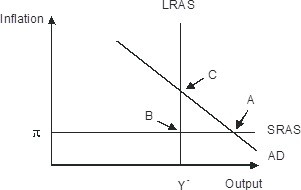

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

The more homogeneous goods are, the more we expect the law of one price to hold

Indicate whether the statement is true or false

In a general equilibrium model

A) all markets but one clear. B) there are no fluctuations. C) all prices are exogenous. D) all prices are endogenous.

Assume that the government increases spending and finances the expenditures by borrowing in the domestic capital markets. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real GDP and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. Real GDP rises, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). b. Real GDP rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). c. Real GDP falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). d. Real GDP and net nonreserve-related international borrowing/lending remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.