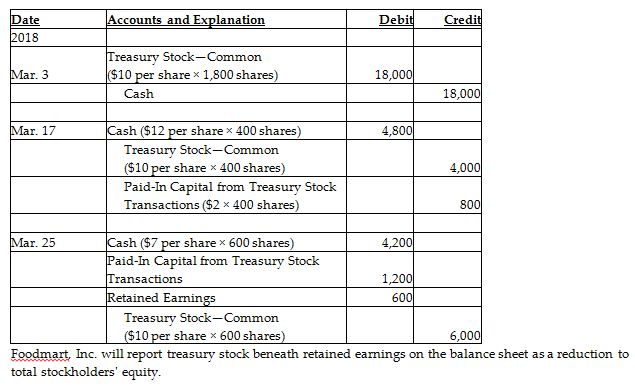

Foodmart, Inc. completed the following treasury stock transactions in 2018:

Mar. 3 Purchased 1,800 shares of the company's $3 par value common stock as treasury stock, paying cash of $10 per share.

Mar. 17 Sold 400 shares of the treasury stock for cash of $12 per share.

Mar. 25 Sold 600 shares of the treasury stock for cash of $7 per share.

(Assume the balance in Paid-In Capital from Treasury Stock Transactions on March 24 is $ 1,200.)

Journalize these transactions. Explanations are not required.

How will Foodmart, Inc. report treasury stock on its balance sheet as of Decembe

You might also like to view...

The ________ inventory system updates accounting records for each purchase and each sale of inventory.

Fill in the blank(s) with the appropriate word(s).

Why is one reason IJVs succeed?

a) Similar goals b) Divergent objectives c) Cultural conflict d) Control problems

If you're a manufacturer, and you want to showcase your product in a store that has a narrow but deep selection of merchandise and where expert sales associates can assist customers with their selections, you'd most likely choose a(n)

A. specialty store. B. warehouse club. C. extreme value retailer. D. department store. E. category specialist.

The numbering system used in a company's chart of accounts:

A. Typically begins with balance sheet accounts. B. Typically begins with income statement accounts. C. Depends on the source documents used in the accounting process. D. Is the same for all companies. E. Is determined by generally accepted accounting principles.