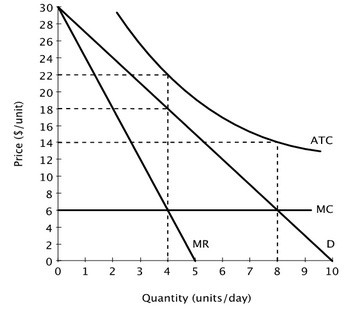

The accompanying figure shows the demand curve, marginal revenue curve, marginal cost curve and average total cost curve for a monopolist. At this monopolist's profit-maximizing level of output, it:

At this monopolist's profit-maximizing level of output, it:

A. earns an economic profit of $16 per day.

B. earns an economic profit of $64 per day.

C. incurs an economic loss of $16 per day.

D. incurs an economic loss of $64 per day.

Answer: C

You might also like to view...

Stabilization policy refers to attempts to

A) shift the AD curve to smooth short-run fluctuations in output. B) shift the SRAS curve to smooth short-run fluctuations in output. C) shift the AD curve to keep the price level as low as possible. D) shift the SRAS curve to keep the nominal interest rate as low as possible.

Exhibit 6-11 Short-run cost schedule for pizzeria's hourly production TotalProduct TotalCost 0 pizzas $ 20 10 70 20 100 30 150 40 250 In Exhibit 6-11, the marginal cost curve crosses the average total cost curve at

A. 10 pizzas. B. 20 pizzas. C. 30 pizzas. D. 40 pizzas.

Many argue the poor are getting poorer, at least in a relative sense. Evidence that contradicts this is that

A. household spending of the lowest twenty percent of households relative to the highest twenty percent of households has held constant over the last thirty years. B. the official poverty level of income has increased over the years. C. the pretax distribution of income is more equal than the after-tax distribution of income. D. household income of the lowest twenty percent of households relative to the highest twenty percent of households has fallen over the last thirty years.

Refer to Scenario 9.3 below to answer the question(s) that follow. SCENARIO 9.3: Investors put up $520,000 to construct a building and purchase all equipment for a new restaurant. The investors expect to earn a minimum return of 10 per cent on their investment. The restaurant is open 52 weeks per year and serves 900 meals per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $1,000 per week in other fixed costs. Variable costs include $1,000 in weekly wages and $600 per week for materials, electricity, etc. The restaurant charges $5 on average per meal. Refer to Scenario 9.3. The normal return to the investors on a weekly basis is

A. $600. B. $1,000. C. $3,600. D. $4,500.