If an investment (where the costs are incurred before then profits) makes sense when the interest rate on the borrowed money to pay for it is 10%,

A. a decrease in the interest rate will cause the investment to be less profitable, but it may still make money.

B. an increase in the interest rate will cause the investment to be more profitable.

C. an increase in the interest rate will cause the investment to lose money.

D. a decrease in the interest rate will cause the investment to make even more money.

Answer: D

You might also like to view...

Which of these is NOT a potential benefit provided by monopolies?

a. more variety of creative works such as movies and books b. greater incentives to develop new technologies and medical cures c. increased consumer surplus as a result of a smaller scale of operations d. lower prices in industries with very large economies of scale

Economic profits and the performance of stock

A) are independent of each other. B) are negatively related. C) are positively related. D) are positively related only during downturns in the business cycle.

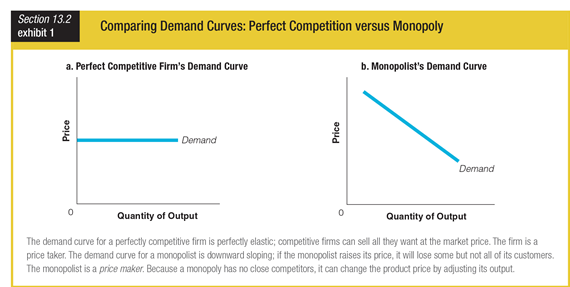

By looking at the demand curves for perfectly competitive firms and for monopolies, you can see that ______.

a. monopolists can change price by adjusting quantity

b. perfectly competitive firms can change price by adjusting quantity

c. monopolists deal with perfectly elastic demand

d. perfectly competitive firms deal with downward sloping demand

The three possible sources of government funding include

A. international income, personal income taxes, and export taxes. B. foreign aid, revenues, and implicit fees. C. explicit fees, taxes, and borrowing. D. None of these are correct.