Suppose the government spending multiplier is 1.5. This means that

A) a $1 decline in government spending will raise Real GDP by $1.50.

B) a $1 rise in government spending will raise both total spending and Real GDP (assuming prices are constant) by $1.50.

C) a $1 rise in government spending will raise investment spending by $1.50.

D) a $1 rise in government spending will change interest rates by 1.50 times what it was before the $1 rise in government spending.

E) none of the above

B

You might also like to view...

The predominant liability item for most banks is: a. deposits

b. bonds. c. loans. d. federal cash reserves.

If the marginal cost of adding a new line of products is $10 million, then Amazon should add the product

What will be an ideal response?

What is national income? List its components

What will be an ideal response?

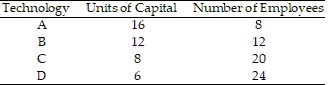

Use the information provided in Table 7.2 below to answer the question(s) that follow.

Table 7.2Inputs Required to Produce a Product Using Alternative Technologies Refer to Table 7.2. Which technology is the least capital intensive?

Refer to Table 7.2. Which technology is the least capital intensive?

A. A B. B C. C D. D