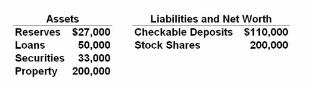

Refer to the data. Assuming the bank loans out all of its remaining excess reserves as a checkable deposit, and has a check cleared against it for that amount, its reserves and checkable deposits will now be:

Use the following balance sheet for the ABC National Bank in answering the question. Assume the required reserve ratio is 20 percent.

A. $25,000 and $122,000 respectively.

B. $22,000 and $110,000 respectively.

C. $32,000 and $115,000 respectively.

D. $22,000 and $105,000 respectively.

B. $22,000 and $110,000 respectively.

You might also like to view...

If the required reserve ratio is .25, demand deposits are $400 million, and total reserves are $150 million, then excess reserves are

A) $25 million. B) $50 million. C) $75 million. D) $125 million.

The proposition that decreases in taxes that raise the government budget deficit has no effect on aggregate demand is called the

A) open-economy effect. B) federalism effect. C) Ricardian equivalence theorem. D) interest-rate effect.

Differentiate between “off-budget” deficit and the “on-budget” deficit.

What will be an ideal response?

For the United States since 1950, imports as a percentage of GDP has

A) tripled. B) increased slightly. C) remained constant. D) decreased.