Why do some diversification efforts pay off and others produce poor results? Why should companies even bother with diversification initiatives?

What will be an ideal response?

Feedback: Discuss what businesses a corporation should compete in and how these businesses should be managed to jointly create more value than if they were freestanding units. Keep in mind that diversification initiatives-whether through mergers and acquisitions, strategic alliances and joint ventures, or internal development-must be justified by the creation of value for shareholders.

You might also like to view...

Which is the first date when employees can exercise their stock options?

a. vesting date b. grant date c. exercise date d. liquidating date

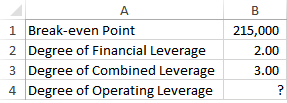

What should be the formula in B4?

a) =B1/(B2+B3)

b) =B3/B2

c) =B2/B3

d) =B2*B3

e) =B2+B3

As units are completed, their costs are transferred from the Work in Process Inventory account to the Finished Goods Inventory account

Indicate whether the statement is true or false

Answer the following statements true (T) or false (F)

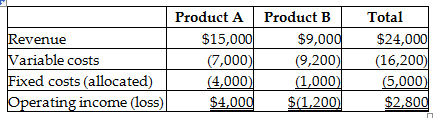

A company has two different products that sell to separate markets. Financial data are as follows:

Assume that fixed costs are all unavoidable and that dropping one product would not impact sales of the other. Because the contribution margin of Product B is negative, it should be dropped.