Which of the following is true? When there are no externalities, public goods, common resources, taxes or subsidies, then

i. allocative efficiency occurs when marginal benefit exceeds marginal cost by as much as possible.

ii. an a competitive equilibrium, resource allocation is efficient.

iii. fair rules require income transfers from the rich to the poor.

A) only ii

B) only i

C) only iii

D) i and ii

E) i and iii

A

You might also like to view...

________ money could be used for some other purpose other than as a medium of exchange, for example, gold coins could be melted down and turned into gold jewelry

A) Commodity B) Fiat C) Paper D) Electronic

A tax that is designed to be progressive will improve

A. Efficiency. B. Vertical equity. C. Equality. D. Horizontal equity.

The ownership of stock of assets is

A. wealth. B. capital investment. C. debt. D. capital consumption.

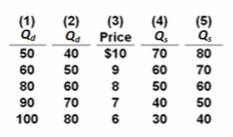

Refer to the table. If demand is represented by columns (3) and (2) and supply is represented by columns (3) and (5), equilibrium price and quantity will be:

A. $10 and 60 units.

B. $9 and 50 units.

C. $8 and 60 units.

D. $7 and 50 units.