Following a new deposit of $500, the loans of a commercial bank increase by $400. In this situation, the reserve ratio is most likely

A) 180 percent. B) 80 percent. C) 20 percent. D) 0 percent.

C

You might also like to view...

What economic problems persist in Latin America? How has this shaped recent policy in the region and why are changes particularly challenging?

What will be an ideal response?

Which of the following is not a reason why aggregate demand decreased following the housing bubble collapse?

A. People stopped investing in homes. B. Consumption decreased. C. Business investment decreased. D. Costs of production increased throughout the economy.

Suppose that the consumer price index at year-end 2010 was 180 and by year-end 2011 had risen to 189 . What was the inflation rate during 2011?

a. 4.8 percent b. 5 percent c. 6 percent d. 9 percent

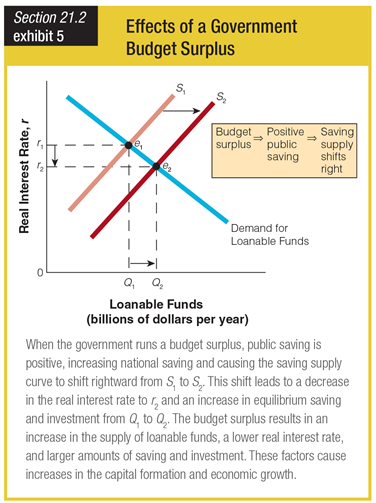

Based on the graph showing the effects of a government budget surplus, when a surplus makes the loanable funds supply shift from S1 to S2, the real interest rate will ______.

a. remain at r1

b. remain at r2

c. rise from r2 to r1

d. drop from r1 to r2