X Company Purchases a (100%) controlling interest in Y Company by issuing $2,000,000 worth of common shares. An agreement was drawn whereby X Company would pay 10% of any earnings in excess of $750,000 to Y's shareholders in the first year following the acquisition. On that date, X's shares had a market value of $80 per share.

Required:

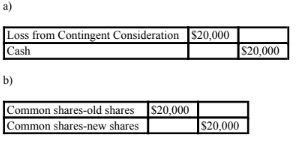

a) Assuming that Y's net income was $950,000, prepare any journal entries (for

company X) that you feel may be necessary to reflect Y's results under IFRS 3

Business Combinations. Assume that on the acquisition date no provision was

made for the contingent consideration.

b) Assuming that the agreement called for Y's shareholders to be compensated

for any decline in X's share price, what journal entries would be required under

IFRS 3, if the market value of X's shares dropped to $64?

You might also like to view...

Chow Company sold a car for $18,100. The cost of the car was $37,500 and an accumulated depreciation of $20,400 had been recorded on the same. The entry to record the disposal of the car is:

A) Accumulated Depreciation-Automobile 20,400 Cash 18,100Automobile 37,500Gain on Sale of Automobile 1,000 B) Accumulated Depreciation-Automobile 37,500 Automobile 37,500 C) Accumulated Depreciation-Automobile 20,400 Automobile 20,400 D) Automobile 37,500 Cash 37,500

Landor Appliance Corporation makes and sells electric fans. Each fan regularly sells for $42. The following cost data per fan is based on a full capacity of 150,000 fans produced each period. Direct materials$8Direct labor$9Manufacturing overhead (70% variable and 30% unavoidable fixed)$ 10A special order has been received by Landor for a sale of 25,000 fans to an overseas customer. The only selling costs that would be incurred on this order would be $4 per fan for shipping. Landor is now selling 120,000 fans through regular channels each period. Assume that direct labor is an avoidable cost in this decision. What should Landor use as a minimum selling price per fan in negotiating a price for this special order?

A. $31 per fan B. $27 per fan C. $24 per fan D. $28 per fan

Ricord Books, a publication house, faced huge losses after 2008. The majority of its readers were born during the late 1950s, whose population was rapidly declining. Most modern readers preferred using e-books rather than reading from hard copies. This resulted in a decrease in the sales of Ricord Books. Identify the dimension of the social environment that this scenario exemplifies.

A. Ethical policy B. Social responsibility C. Diverse workforce D. Aging population

A special indorsement does not specify a particular indorsee.

Answer the following statement true (T) or false (F)