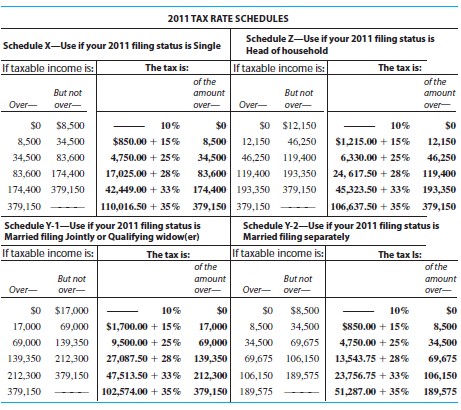

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Brian Moss had wages of $72,328, dividends of $374, interest of $686, and adjustments to income of $1065 last year. He had deductions of $875 for state income tax, $455 for city income tax, $985 for property tax, $6691 in mortgage interest, and $185 in contributions. He claims two exemptions and files as head of household.

Brian Moss had wages of $72,328, dividends of $374, interest of $686, and adjustments to income of $1065 last year. He had deductions of $875 for state income tax, $455 for city income tax, $985 for property tax, $6691 in mortgage interest, and $185 in contributions. He claims two exemptions and files as head of household.

A. $8873.25

B. $8700.50

C. $2543.25

D. $10,998.25

Answer: B

Mathematics

You might also like to view...

Use the given transformation to evaluate the integral. src="https://sciemce.com/media/4/ppg__ghvb0609192137__f1q39g7.jpg" alt="" style="vertical-align: -4.0px;" />

Rwhere R is the parallelepiped bounded by the planes

Rwhere R is the parallelepiped bounded by the planes

A.

B.

C. 75

D.

Mathematics

List all the elements of B that belong to the given set.B = {4,  , -23, 0,

, -23, 0,  , -

, -  , 2.2}Natural numbers

, 2.2}Natural numbers

A. {4, 0}

B. {-23, 0, 4}

C. {4}

D.

Mathematics

Find all solutions to the equation. Express the solution in degrees.cos x = 0

A. 90° + 360°n B. 180°n C. 90° + 180°n D. 360°n

Mathematics

Compare dy and

with

?

A.

B.

C.

D.

E.

Mathematics