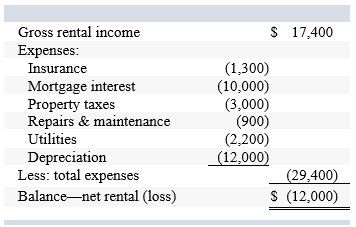

Don owns a condominium near Orlando, California. This year, he incurs the following expenses in connection with his condo: Insurance$1,300Mortgage interest 10,000Property taxes 3,000Repairs and maintenance 900Utilities 2,200Depreciation 12,000 During the year, Don rented the condo for 70 days and he received $17,400 of rental receipts. He did not use the condo at all for personal purposes during the year. Don is considered to be an active participant in the property. Don's AGI from all sources other than the rental property is $140,000. Don does not have passive income from any other sources. What is Don's AGI?

What will be an ideal response?

$135,000

$140,000 + ($5,000)

Because Don is an active participant in the property, he is allowed to deduct ($5,000) of the passive loss this year [$25,000 active participant maximum less ($140,000 ? $100,000) × 0.5 (phase-out of AGI over $100,000 threshold)].

You might also like to view...

Answer the following statements true (T) or false (F)

1. An accounts receivable turnover that is too high may indicate that credit is too tight, causing the loss of sales to good customers. 2. The debt ratio is the ratio of total debt divided by total equity. 3. The debt to equity ratio shows the proportion of total liabilities relative to total equity. 4. The times-interest-earned ratio measures the number of times earnings before interest and taxes can cover interest expense. 5. The rate of return on total assets measures a company's success in using its assets to earn a profit.

According to the pie-chart figure in the text, what industry type accounted for the highest percentage of franchises?

a. Business services b. Lodging c. Personal services d. Real estate

Accounting and legal services are examples of _____ services

a. proforma b. rented-goods c. nongoods d. owned-goods

Sylvia creates a profile for Today's Date, Inc., an online dating service. She exaggerates her appealing features and posts a photo of her friend Uva, whom Sylvia thinks is prettier. Enticed by the profile, Van subscribes to the service so that he can contact Sylvia. Van is most likely a victim of

A. undue influence. B. fraud. C. mistake. D. nothing.