Agri-Tech supplies is a patented sweetener to various food processors. It has noticed that the value of the sweetener varies dramatically from one buyer to another, depending on the end-use demand. But its experiments with charging higher prices to some buyers have failed. The demand for the juices is highly price elastic while the demand for sweetened medicine is relatively less elastic. Can Agri-Tech find a way to successfully price discriminate?

What will be an ideal response?

The problem likely comes from the more price sensitive customers buying at a low price and reselling to the less elastic customers. To prevent this type of arbitrage, Agri-Tech could acquire the more price sensitive customers. Then the less price sensitive customers would have to buy from Agri-Tech instead of a reseller, and Agri-Tech could mark up price accordingly. However, acquiring these types of companies would take Agri-Tech well out of its area of competitive strength, and is not likely a good strategic move. It is often very difficult or costly to prevent arbitrage in situations like this, and it may make more sense to charge the same price from all customers.

You might also like to view...

Countries that experience very high rates of inflation may also have

A) balanced budgets. B) rapidly growing money supplies. C) falling money supplies. D) constant money supplies.

Which one of these is not a characteristic of capitalism?

A. Central planning B. Private property C. The price mechanism D. Competition

The indifference curves for nickels and dimes will be

A. a straight line with negative slope. B. a straight line with positive slope. C. concave. D. L-shaped.

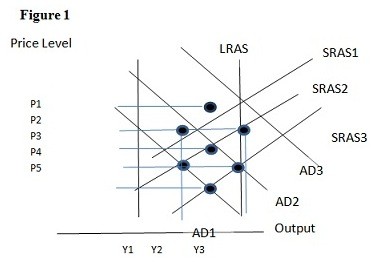

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the long run would be:

A. P2 and Y2. B. P1 and Y2. C. P4 and Y2. D. P1 and Y1.