Assume the government decides to reduce spending in order to reduce the budget deficit, which it financed by borrowing in the real credit market. What is the first round effect on the value of the domestic currency, if there is low mobility in the international capital markets?

a. The value of the currency rises.

b. The value of the currency falls.

c. The value of the currency is unaffected.

d. The change in the value of the currency is ambiguous.

.A

You might also like to view...

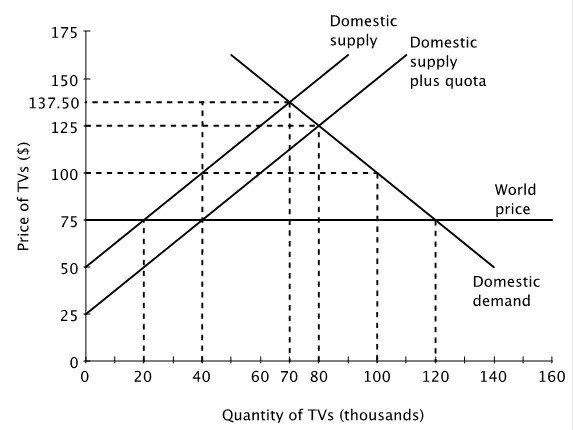

After the imposition of the quota, the amount of revenue collected by the government is ________.

A. $75,000 B. $0 C. $150,000 D. $50,000

If the government issues new government bonds to finance a budget deficit, the supply of loanable funds will ________ and the equilibrium amount of investment will ________

A) increase; increase B) increase; decrease C) decrease; increase D) decrease; decrease

Suppose Mara and David compete, selling fried green tomatoes in a perfectly competitive market. If Mara increases output,

a. David must reduce output b. the price David can charge falls c. the price David can charge rises d. the price David can charge is unaffected e. David's economic profit must fall

The most extensive indexing in the United States is in

a. interest payments on bonds or savings accounts. b. government transfer payments, including Social Security benefits. c. government contracts for military goods. d. escalator clauses in wage and salary contracts.