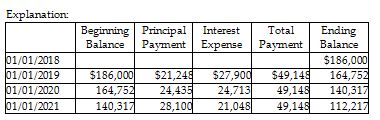

On January 1, 2018, Allgood Company purchased equipment and signed a six-year mortgage note for $186,000 at 15%. The note will be paid in equal annual installments of $49,148, beginning January 1, 2019. Calculate the portion of interest expense paid on the third installment

(Round your answer to the nearest whole number.)

A) $49,148

B) $21,048

C) $27,900

D) $164,752

B) $21,048

You might also like to view...

Which component of an attitude contains the feelings or emotions a person has about a product?

A) affective B) cognitive C) conative D) rational

All of the following involve a temporary difference for purposes of income tax allocation except

A) ?interest on municipal bonds. B) ?gross profit on installment sales for tax purposes. C) ?MACRS depreciation for tax purposes and straight-line for accounting purposes. D) ?product warranty expenses.

A company receives a 10%, 90-day note for $3300. The total interest due on the maturity date is: (Use 360 days a year.)

A. $192.50. B. $82.50. C. $110.00. D. $330.00. E. $165.00.

Placing the main idea first or last in a sentence is a good way to emphasize the idea

Indicate whether the statement is true or false