On January 1, 2016, Smalls, Inc. issued $60,000 of its 12-year 10% bonds for $52,584. Interest is payable annually and the effective yield was 12%. Costs connected with the issue totaled $3,200.Required:

a.Prepare the entry to record the issuance of the bonds.b.Prepare the journal entry to record interest expense in 2017 using the effective interest method.c.Prepare the journal entry to record interest expense in 2017 using the straight-line method.

What will be an ideal response?

?

| a. | Cash ($52,584-$3,200) | 52,584 | ? | |||||

| ? | Discount on Bonds Payable | 7,416 | ? | |||||

| ? | ? | Bonds Payable | ? | 60,000 | ||||

| Deferred Debt Issuance Costs | 3,200 | |||||||

| Cash | 3,200 | |||||||

| ? | ? | ? | ? | |||||

| b. | Bond Interest Expense | 6,614 | ? | |||||

| ? | ? | Deferred Debt Issuance Costs | ? | 267 | ||||

| ? | ? | Discount on Bonds Payable | ? | 347* | ||||

| ? | ? | Cash | ? | 6,000 | ||||

| ? | ? | |||||||

| ? | ? | *BV of Bonds | Int. | Int. | Disc. | |||

| ? | ? | @ Beg. of Yr. | Exp. (12%) | Pd. | Amort. | |||

| ? | 2016 | 52,584 | 6,310 | 6,000 | 310 | |||

| ? | 2017 | 52,894 | 6,347 | 6,000 | 347 | |||

| c. | Bond Interest Expense | 6,885 | ? | ||

| ? | ? | Deferred Debt Issuance Costs | ? | 267* | |

| ? | ? | Discount on Bonds Payable | ? | 618** | |

| ? | ? | Cash | ? | 6,000 | |

| ? | ? | ? | ? | ||

| ? | * | 3,200/12 = $267 per year | ? | ? | |

| ? | ** | 7,416/12 = $618 per year | ? | ? | |

You might also like to view...

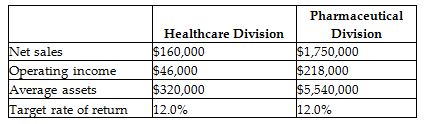

Guardian Corporation has two major divisions— Healthcare Products and Pharmaceutical Products. It provides the following information for the year.

Calculate the residual income for the Healthcare Division.

A) $26,800

B) $7600

C) $114,000

D) $46,000

Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Work in process, beginning: Units in process 900? Percent complete with respect to materials 40?%Percent complete with respect to conversion 20?%Costs in the beginning inventory: Materials cost$530? Conversion cost$2108? Units started into production during the month 16,000? Units completed and transferred out 16,000? Costs added to production during the month: Materials cost$32,180? Conversion cost$416,512? Work in process, ending: Units in process 900? Percent complete with respect to materials?50?%Percent complete with respect to

conversion 50?%Required:Using the FIFO method:a. Determine the equivalent units of production for materials and conversion costs.?Equivalent Units of ProductionMaterials?Conversion?b. Determine the cost per equivalent unit for materials and conversion costs.?Cost per Equivalent UnitMaterials?Conversion?c. Determine the cost of ending work in process inventory.Cost of ending WIP?d. Determine the cost of units transferred out of the department during the month.Cost of units transferred out? What will be an ideal response?

Changes in technology, machinery, or production methods may make past cost data irrelevant when setting standards

Indicate whether the statement is true or false

The project manager role and responsibility that keeps up with current technology developments and is the "go-to" person for a project is the

A) administrator role. B) consultant role. C) coordinator role. D) supervisor role.