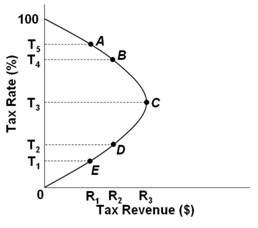

Refer to the Laffer Curve below. A cut in the tax rate from T2 to T1 would:

A. Decrease tax revenues and support the views of supply-side economists

B. Increase tax revenues and support the views of supply-side economists

C. Increase tax revenues and support the views of mainstream economists

D. Decrease tax revenues and support the views of mainstream economists

D. Decrease tax revenues and support the views of mainstream economists

You might also like to view...

Kellogg's and General Mills are two of the dominant breakfast cereal manufactures in the U.S. Each firm can either sign or not sign an exclusive contract with an Olympian gold-medal athlete to appear on the cover of a cereal box

If both companies sign an athlete, they will each make $5 million in economic profit. If only firm signs, they earn $8 million in economic profit and the other firm incurs an economic loss of $1 million. If neither firm signs, they break even. Which of the following pairs of payoffs would NOT appear together in a square of the payoff matrix? A) $5 million; $5 million B) $0 million; $0 million C) $8 million; $5 million D) -$1 million; $8 million

An example of an excludable good or service is:

A. ice cream. B. a public park. C. national defense. D. air.

If a firm faces ______, while the prices for the output the firm produces remain unchanged, a firm’s profits will increase

a. higher demand b. lower costs of production c. equilibrium d. a shift in demand

In the U.S., loans made by Federal Reserve to banks fall in the categories of:

A. reserves. B. discount loans. C. discount loans and foreign exchange reserves. D. discount loans and reserves.