Consider the Taylor rule for the target of the federal funds rate

Suppose the equilibrium real federal funds rate is 2 percent, the target rate of inflation is 3 percent, the current inflation rate is 3 percent, real GDP equals potential real GDP, and the weights are 1/2 for the inflation gap and the output gap. Using the Taylor rule, what does the target for the federal funds rate equal? Next, if the Federal Reserve lowered the target for the inflation rate to 1 percent, how much would the target for the federal funds rate change?

The federal funds target rate would equal 5 percent. With no inflation gap or output gap, the federal funds target rate equals the current inflation rate plus the equilibrium real federal funds rate. A decrease in the inflation target from 3 percent to 1 percent with a weight on the inflation gap of 1/2 would raise the federal funds target rate by 1 percentage point, from 5 percent to 6 percent.

You might also like to view...

Intraindustry trade is characterized by what two features of the industry and market?

A) Diseconomies of scale and homogeneous products B) Non-tariff barriers and large-scale foreign investment C) Quota auctions and low effective rates of protection D) Economies of scale and differentiated products E) Government subsidies and industrial policy

In the simplest Keynesian model of the determination of income, interest rates are assumed

A) to be exogenous and to influence desired spending. B) to be endogenous and not to influence desired spending. C) to be endogenous and to influence desired spending. D) to be exogenous and not to influence spending.

A monopoly will NOT be able to perfectly price discriminate if

A) obtaining information about each buyer's reservation price is too costly. B) demand is very elastic. C) demand is very inelastic. D) resale is impossible.

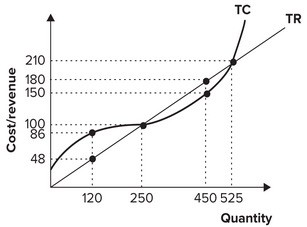

Refer to the graph shown. If the firm is producing 120 units of output, profit is equal to:

A. $30. B. $38. C. $0. D. ?$38.