Your friend's portfolio manager has suggested two high-yielding stocks: Consolidated Edison (ED) and Royal Bank of Scotland (RBS-K). ED shares cost $40, yield 5.5% in dividends, and have a risk index of 1.0 per share. RBS-K shares cost $25, yield 7.5% in dividends, and have a risk index of 1.5 per share. You have up to $24,000 to invest and would like to earn at least $1,320 in dividends. How many shares (to the nearest whole number) of each stock should you purchase in order to meet your requirements and minimize the total risk index for your portfolio?

?

A. Buy 960 shares of ED and 0 shares of RBS-K

B. Buy 0 shares of ED and 600 shares of RBS-K

C. Buy 0 shares of ED and 960 shares of RBS-K

D. Buy 600 shares of ED and 0 shares of RBS-K

E. no solution

Answer: D

Mathematics

You might also like to view...

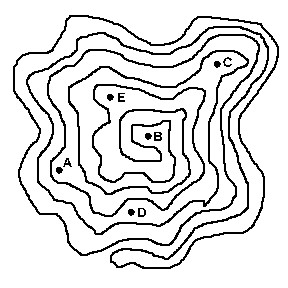

Determine whether the point is inside or outside the Jordan curve.Point D

A. Inside B. Outside

Mathematics

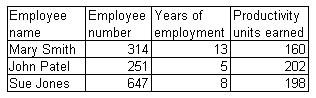

Use the formula  to calculate the yearly bonus for the employee. (x represents the number of productivity units earned and y represents the number of years of employment)

to calculate the yearly bonus for the employee. (x represents the number of productivity units earned and y represents the number of years of employment) Calculate John Patel's yearly bonus.

Calculate John Patel's yearly bonus.

A. 577 B. 207 C. 582 D. 380

Mathematics

Distribute and simplify.y5/9(y3/9 - 5y2/9)

A. y5/3 - 5y5/2 B. y15/81 - 5y10/81 C. y2/9 - 5y3/9 D. y8/9 - 5y7/9

Mathematics

Use the properties of logarithms to solve.logb(x + 3) + logb x = logb 54

A. 6 B. -6 C. -6, -3 D. 3

Mathematics