Mead, Inc. may invest $20 million in a new fiber optic project. Due to market conditions, annual production costs and revenues are forecasted at $10 million and $8 million, respectively, starting next year

Revenues are expected to grow at 4.0% and interest rates are 6.0%. What is the change in value if the project is commenced in 5 years instead of today? (Use static analysis.)

A) $8.84 million

B) $10.84 million

C) $12.84 million

D) $14.84 million

B

You might also like to view...

The strength of association is measured by the ________

A) coefficient of determination B) regression equation C) correlation coefficient D) F factor E) F-statistic

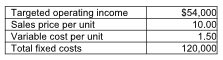

What is the contribution margin ratio? (Round any intermediate calculations and your final answer to two decimal places.)

Psari's, a company that sells fishing nets, provides the following information about its product:

A) 85.00%

B) 100%

C) 75.00%

D) 15.00%

________ are programs that offer professional counseling, medical services, and rehabilitation opportunities to all troubled employees.

A. Workers' compensation programs B. Pre-employment training programs C. Employee assistance programs D. Loss-control programs

Carolyn has an AGI of $38,000 (all from earned income) and two qualifying children and is filing as a head of household. What amount of earned income credit is she entitled to? (Exhibit 8-10)

A. $1,833 B. $5,828 C. $3,995 D. $3,526 E. $0