Carefully explain 'poison pills' as an anti-takeover tactic.

What will be an ideal response?

Poison pills, or shareholder rights plans, allow existing shareholders, under certain conditions, to have the option to buy additional shares at a discount to the current market price. This action is typically triggered when a new shareholder accumulates more than a set percentage of ownership, usually 20 percent. Managers fear that the new shareholder might be masterminding a takeover of the company. In the name of protecting existing shareholders, newly issued stock is offered at a steep discount to all shareholders except the alleged aggressor. As the existing shareholders buy the discounted shares, the stock is diluted significantly, since there are now more shares, each with a lower value. If there has been a takeover bid at a set price per share, the overall price offered for the company immediately goes up by a substantial amount, since more shares are now outstanding. This assures shareholders of receiving a high price for the company. Of course, the takeover bidder is aware of the poison pill provision and is likely to stop just short of accumulating shares beyond the trigger level. Senior management and the board will usually negotiate better terms before removing the poison pill. Often, however, the board will also negotiate to keep senior management and itself in place as part of the deal to remove the pill.

You might also like to view...

An exporter that is new to a particular market would do well to choose a middleman with a reputation for "cherry picking" products

Indicate whether the statement is true or false

With the equity method, the investor recognizes its share of the earnings of the subsidiary when the

A) investor sells the investment. B) investee pays a cash dividend. C) investee declares a cash dividend. D) investee reports earnings on its income statement.

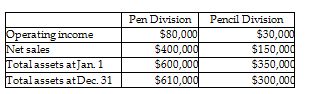

Provisions Company, a manufacturer of office supplies, provides the following financial information:

Calculate the return on investment for the Pen Division. (Round your answer to two decimal places.)

A) 13.22%

B) 9.23%

C) 13.33%

D) 13.11%

Wang Co. manufactures and sells a single product that sells for $450 per unit; variable costs are $270 per unit. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Compute the break-even point in dollars.

A. $2,640,000. B. $1,304,348. C. $1,740,000. D. $4,202,899. E. $2,000,000.