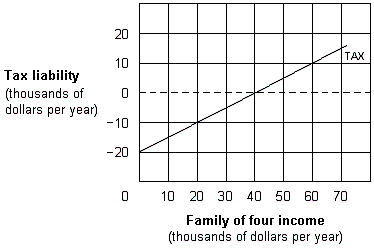

Exhibit 12-7 Negative income tax

Under the negative income tax scheme in Exhibit 12-7, families earning between $10,000 and $40,000 would:

A. receive the maximum negative income tax payment of $20,000.

B. receive payments under the negative income tax.

C. pay no income taxes, but receive no payments.

D. pay taxes of $5,000.

Answer: B

You might also like to view...

When the Federal Reserve wants to slow inflation, it

A) lowers the federal funds rate. B) increases taxes on interest income. C) raises the federal funds rate target. D) increases aggregate income, output, and employment. E) cuts the federal funds rate target aggressively to almost zero.

The World Trade Organization (WTO) was created in 1995 during the Uruguay Round of trade discussions

Indicate whether the statement is true or false

Unemployment caused by the normal search time required by workers with marketable skills who are changing jobs, those initially entering the labor force, or those re-entering the labor force is;

A. Seasonal unemployment B. Frictional unemployment C. Correct!Structural unemployment D. Cyclical unemployment

The fiscal policy action most likely to increase investment spending would be ______.

a. increasing the individual income tax rate b. decreasing the individual income tax rate c. increasing the business tax rate d. decreasing the business tax rate