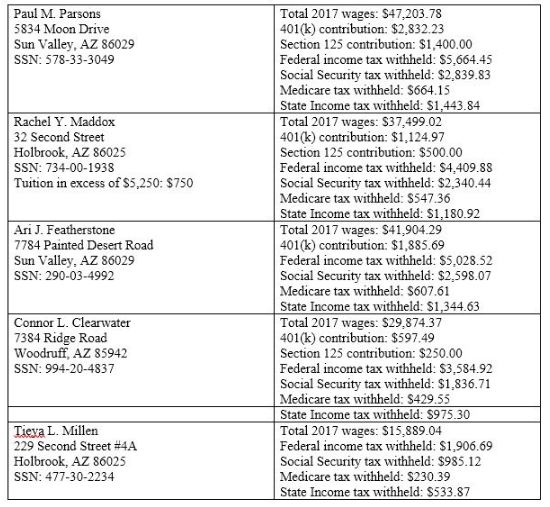

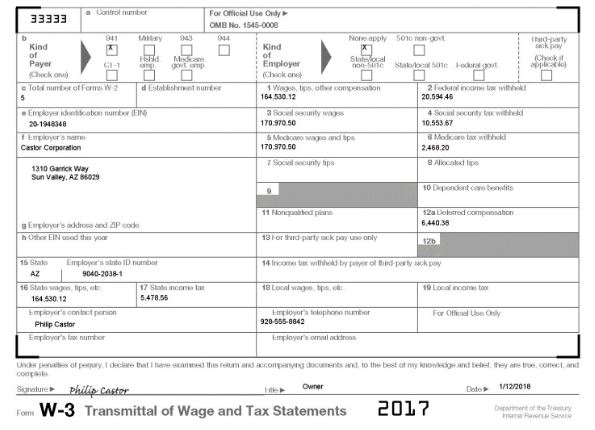

Using the information below for Castor Corporation, complete Form W-3 that must accompany the company's Forms W-2. Castor Corporation is a 941-SS payer and is a private, for-profit company. No third-party sick pay applied for 2017. The W-3 was signed and submitted January 12, 2018.

What will be an ideal response?

You might also like to view...

Direct cause-and-effect relationships between revenues and expenses can be identified easily

Indicate whether the statement is true or false

The members of the __________ are appointed by the Financial Accounting Foundation

a. American Accounting Association. b. Financial Accounting Standards Board c. Securities and Exchange Commission. d. American Institute of Certified Public Accountants.

Bank fees for check printing are recorded by the bank as:

A. A decrease in the depositor's bank account. B. A decrease in the bank's asset account. C. An increase in the depositor's bank account. D. An increase in the bank's asset account. E. An increase in the bank's expense account.

Contract law does not distinguish between promises that create only moral obligations and promises that are legally binding

Indicate whether the statement is true or false