This year, Plateau, Inc.'s before-tax income was $4,765,000. Plateau paid $310,000 income tax to state A and $130,000 income tax to state B.a. Compute Plateau's federal taxable income and tax liability. b. What is Plateau's overall income tax rate?

What will be an ideal response?

a. Federal taxable income: $4,325,000 = $4,765,000 ? $310,000 ? $130,000. Federal tax liability: $908,250.

b. Overall income tax rate: 28.3% = ($908,250 + $310,000 + $130,000)/$4,765,000.

You might also like to view...

In giving feedback to a subordinate, a manager should

A. communicate her general impression of the subordinate. B. avoid giving negative feedback. C. deliver feedback through a one-way communication process. D. save giving feedback for annual or semi-annual formal appraisals. E. keep diaries about specific incidents of the subordinates' performance.

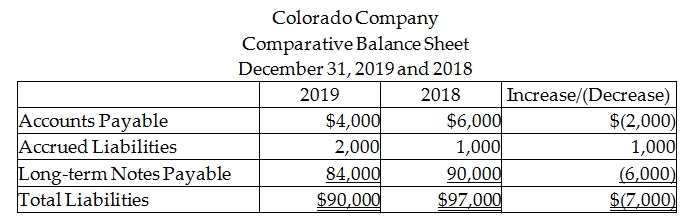

How will the change in Accrued Liabilities be shown on the statement of cash flows?

Colorado Company uses the indirect method to prepare the statement of cash flows. Refer to the following section of the comparative balance sheet:

A) as an addition to Net Income

B) as a deduction from Net Income

C) as a deduction from operating cash flows

D) as an addition to investing cash flows

Answer the following statements true (T) or false (F)

1. One of the reasons a process may need to be reexamined once it has been implemented is that the product is not selling well. 2. Value stream mapping assesses the time taken for each step in the value stream. 3. Potential for outsourcing needs to be considered in offering a service. 4. The volume of service is low for mass services. 5. A goal for manufacturers in designing their individual internal processes is to provide locations most convenient for the manufacturers.

Distinguish between limited protected speech and unprotected speech as categorized by the U.S. Supreme Court

What will be an ideal response?