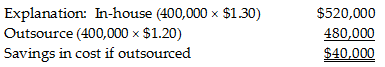

Lightning Semiconductors produces 400,000 hi-tech computer chips per month. Each chip uses a component that Lightning makes in-house. The variable costs to make the component are $1.30 per unit, and the fixed costs are $1,300,000 per month. The company has been approached by a foreign producer who can supply the component, within acceptable quality standards, for $1.20 each. The fixed costs are unavoidable, and Lightning would have no other use for the facilities currently employed in making the component. What would be the effect on operating income if the company decides to outsource?

A) There would be no effect on operating income.

B) Lightning Semiconductors could save $1,300,000 per month in costs.

C) Lightning Semiconductors could save $40,000 per month in costs.

D) Lightning Semiconductor's costs would increase by $480,000 per month.

C) Lightning Semiconductors could save $40,000 per month in costs.

You might also like to view...

On November 1, 2019, Alpha Omega, Inc. sold merchandise for $15,000, FOB destination, with payment terms, n/30. The cost of goods sold was $5,100. On November 3, the customer returns on this sale amounted to $6,000. The company received the balance on November 9, 2019. Calculate the cost of goods sold from these transactions.

A) $2,040 B) $5,940 C) $5,100 D) $3,060

The state of Ohio has passed a law requiring that every automobile be inspected at least once a year for pollution control. Anson Enterprises is considering entering into this type of business. After extensive Mark Anson has developed the following set of projected annual data on which to make his decision: Direct service labor $363,000.00 Variable service overhead costs 270,000.00 Fixed service

overhead costs 280,000.00 Marketing expenses 120,000.00 General and administrative expenses 170,000.00 Minimum profit 90,000.00 Cost of assets employed 500,000.00 Anson believes that his company will inspect 100,000 automobiles per year. The company earns an average of 18.75 percent return on its assets. The price to be charged for inspecting each automobile using the time and materials pricing method would be calculated as A) ($913,000.00 ÷ 100,000 ) + {($913,000.00 ÷ 100,000 ) x [($90,000 + $290,000 ) ÷ $913,000.00]}. B) ($1,203,000.00 ÷ 100,000 ) + [($1,203,000.00 ÷ 100,000 ) x ($90,000 ÷ $1,203,000.00)]. C) ($1,203,000.00 ÷ 100,000 ) + [($500,000 ÷ 100,000 ) x 0.1875]. D) none of these options.

________ fairness, and legal compliance are the 3 consequences of an internally aligned pay structure.

A. Culture B. Organization factors C. Economic pressures D. Efficiency E. Human capital

Committees of the board of directors increase the efficiency of the board.

Answer the following statement true (T) or false (F)