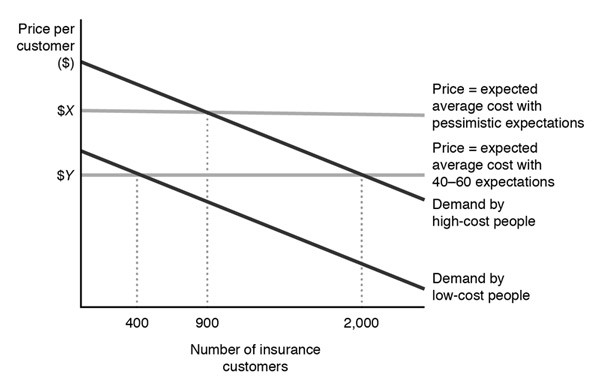

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. The insurance companies estimate that 40% of its customers are high-cost type. If the insurance companies set the price equal to their average cost per customer, what percent of customers who buy the insurance are actually low-cost customers?

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. The insurance companies estimate that 40% of its customers are high-cost type. If the insurance companies set the price equal to their average cost per customer, what percent of customers who buy the insurance are actually low-cost customers?

A. 20%

B. more than 20% but less than 50%

C. more than 50%

D. less than 20%

Answer: D

You might also like to view...

According to Pigovian analysis, competitive behavior will result in overproduction of a good when

a. firms' activities create external costs. b. people outside of market transactions benefit from those transactions. c. property rights have been clearly and unambiguously assigned. d. private and social marginal costs are identical.

The reason that the government offers inventors exclusive rights to their product for a period of time is to

A) promote innovation. B) increase profits of certain companies. C) maximize consumer utility. D) reduce market concentration.

The multiplier that arises from equal increases in government spending and taxes is called the

A) balanced budget multiplier. B) simple multiplier. C) tax multiplier. D) government spending multiplier.

Suppose that from a new checkable deposit, First National Bank holds two million dollars in vault cash, nine million dollars in excess reserves, and faces a required reserve ratio of ten percent

Given this information, we can say First National Bank has ________ million dollars in required reserves. A) one B) two C) eight D) ten