The total burden of a tax is $10,000 and the tax revenue from this tax is $8,000. The excess burden of this tax is

A. $2,000.

B. $8,000.

C. $10,000.

D. $18,000.

Answer: A

You might also like to view...

The entry of China and other developing countries into the global economy ________ the wages of low-skilled workers and ________ the wages of high-skilled workers in the United States

A) lowers; lowers B) raises; raises C) raises; lowers D) lowers; raises

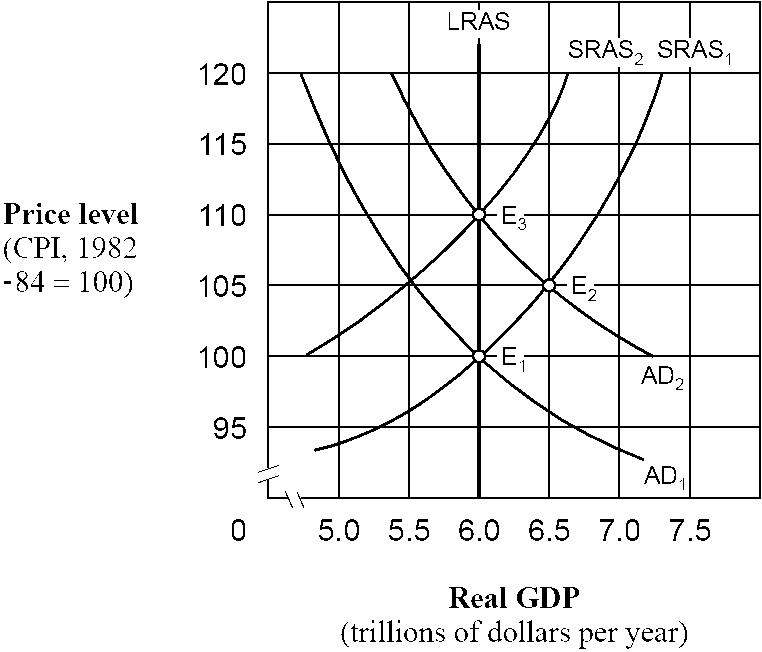

Figure 15-3

As shown in , if people behave according to adaptive expectations theory, an increase in the aggregate demand curve from AD1 to AD2 will cause

a.

labor to adjust nominal wages sluggishly.

b.

the aggregate supply curve to shift from SRAS1 to SRAS2

c.

the price level to eventually rise from 100 to 110.

d.

All of the above.

Which one of the following statements is NOT accurate in relation to shareholders and their conduct in a? corporation?

A. Because shareholders elect the? directors, in theory the shareholders are the final governing body of the corporation. B. Shareholder activism has become a progressively noticeable issue in corporate governance. C. Because shareholders elect the? directors, institutional stockholderslong dash—such as pension? funds, insurance? companies, mutual? funds, religious? organizations, and college endowment fundslong dash—have significant impact on the governance of corporations. D. Even though most do not have any direct participation in firm? management, shareholders play a significant role in corporate governance. E. Activist shareholders are becoming better prepared and more classy.

The economic development of a country is dependent on all of the following except

What will be an ideal response?