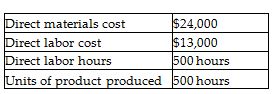

Olympia Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, Olympia estimated total manufacturing overhead costs at $1,010,000 and total direct labor costs at $820,000. In June, Job 511 was completed. The details of Job 511 are shown below.

What is the amount of manufacturing overhead costs allocated to Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar.)

A) $16,012

B) $29,561

C) $10,554

D) $19,485

A) $16,012

You might also like to view...

According to philosophical ethics, a simple acceptance of customary norms is an adequate ethical perspective.

Answer the following statement true (T) or false (F)

If Bojana Tax Services' office supplies account balance on March 1 was $1,400, the company purchased $675 of supplies during the month, and a physical count of supplies on hand at the end of March indicated $1,250 unused, what is the amount of the adjusting entry for office supplies on March 31?

A. $1,250 B. $525 C. $1,975 D. $825 E. $675

In the context of corporate restructuring, a common objective of a horizontal merger is to:

A. improve efficiency by eliminating duplication of facilities and personnel. B. provide tighter integration of production and increased control over the supply of crucial inputs. C. reduce risk by making a firm less vulnerable to adverse conditions in any single market. D. transfer partial ownership of operations to investors.

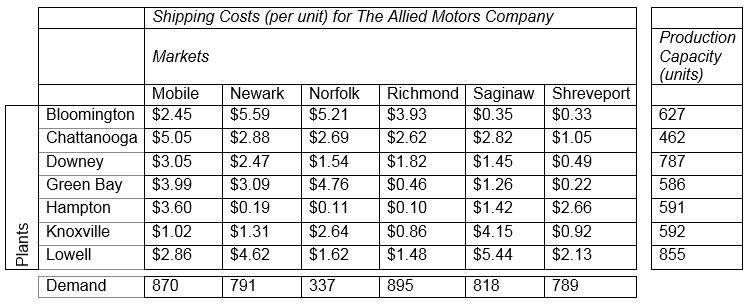

Refer to the Shipping Costs for The Allied Motors Company. Solve the transportation problem using Excel Solver. (Remember that in balanced transportation problems all constraints--except the nonnegativity constraints of the decision variables--should be set as an equal to (=) sign in the Excel Solver dialogue.) At the optimum solution, the number of units shipped from Knoxville to Mobile is ______.

A. 592

B. 617

C. 243

D. 433