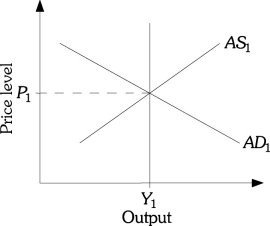

Refer to the information provided in Figure 32.2 below to answer the question(s) that follow. Figure 32.2Refer to Figure 32.2. According to the ________ economists, under rational expectations an expected decrease in taxes would not change AD or AS.

Figure 32.2Refer to Figure 32.2. According to the ________ economists, under rational expectations an expected decrease in taxes would not change AD or AS.

A. Keynesian

B. the new classical

C. monetarist

D. none of the above

Answer: B

You might also like to view...

When a firm experiences a zero economic profit, ______.

a. neither economic nor accounting profits are positive b. economic profits and accounting profits are equivalent c. accounting profits are zero, but economic profits are positive d. economic profits are zero, but accounting profits are positive

One study of the distribution of wealth indicates that the bottom 40 percent of households hold 1 percent or less of total marketable wealth in the United States. Which of the following people is most likely to be in the bottom 40 percent?

A. Debra is 45 years old, and the only money she gets is $40,000 of rental payments from an apartment building she owns that is worth $250,000. She owes the bank $50,000. B. Betty is 29 years old, earns $40,000 a year, has $80,000 in a savings account, and has credit card debt of $4,000. C. Carol is 69 years old, is disabled, and is living on Social Security and dividends from her $500,000 of mutual funds. She has no debt. D. Ann is 29 years old, earns $120,000 a year, has no financial assets, but still has student loans of $4,000.

The fact that U.S. citizens expect to receive retirement benefits through Social Security and Medicare pushes their:

A. supply of loanable funds further right than it would otherwise be. B. demand for loanable funds further right than it would otherwise be. C. supply of loanable funds further left than it would otherwise be. D. demand for loanable funds further left than it would otherwise be.

In the early 2000s in Ecuador, the central bank financed the government deficit and created high inflation. The high level of inflation and its relationship to the government deficit are an example of:

A. disinflation. B. the underground economy. C. an inflation tax. D. the central bank dependency.