Suppose that income tax revenues are maximized at an average (income) tax rate of 45 percent. If the Laffer curve is a correct diagrammatic representation of the relationship between tax rates and tax revenue, it follows that a tax rate of

A) 35 percent will reduce tax revenues.

B) 48 percent will reduce tax revenues.

C) 48 percent will generate as much tax revenue as a tax rate of 45 percent.

D) 35 percent will generate as much tax revenue as a tax rate of 45 percent.

E) a and b

E

You might also like to view...

A nation's investment must be financed by

A) national saving only. B) the government's budget deficit. C) borrowing from the rest of the world only. D) national saving plus borrowing from the rest of the world.

Last year, on advice from your sister, you bought stock in Burpsy Soda at $100/share. During the year, you collected a $2 dividend and then sold the stock for $120/share. You experienced a

A) dividend yield of 9%. B) dividend yield of 20%. C) dividend yield of 11%. D) total return of 20%. E) total return of 22%.

How does the ratio of CEO pay in the U.S. compare with that ratio in Japan?

A. It is much lower. B. It is slightly lower. C. It is slightly higher. D. It is much higher.

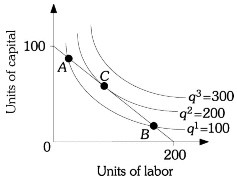

Refer to the information provided in Figure 7.10 below to answer the question(s) that follow.  Figure 7.10Refer to Figure 7.10. The firm's level of total cost is represented by the given isocost line. At the optimal combination of capital and labor, the firm produces ________ units of output.

Figure 7.10Refer to Figure 7.10. The firm's level of total cost is represented by the given isocost line. At the optimal combination of capital and labor, the firm produces ________ units of output.

A. 100. B. 200. C. 300. D. indeterminate from this information.