The effective tax rate is

A. The percentage of tax payable on the last dollar of income received.

B. Never higher than the nominal tax rate.

C. Always equal to the marginal tax rate.

D. Equal to the taxes paid divided by taxable income.

Answer: B

You might also like to view...

Suppose the government imposes a 20-cent tax on the sellers of iced tea. Which of the following is not correct? The tax would

A. discourage market activity. B. reduce the equilibrium quantity. C. raise the equilibrium price by 20 cents. D. shift the supply curve upward by 20 cents.

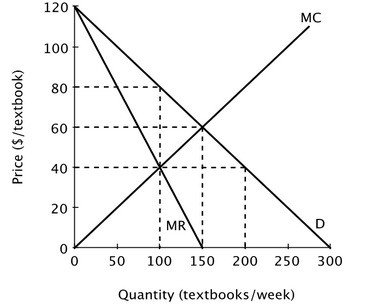

Suppose the accompanying figure shows the demand curve, marginal revenue curve and marginal cost curve for a monopolist. At this monopolist's profit-maximizing level of output, deadweight loss equals ________.

At this monopolist's profit-maximizing level of output, deadweight loss equals ________.

A. $2,000 B. $1,000 C. $6,000 D. $4,000

Which of the following examples is motivated by nonmonetary self-interest?

a. updating factory equipment to improve efficiency b. giving to the boss’s favorite charity with the hope of getting a raise c. increasing employee pay to improve motivation to make sales d. giving donations to help victims of an earthquake

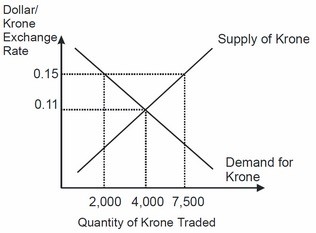

Based on this figure, if the krone exchange rate is fixed at $0.15 dollars per krone, then the krone is:

A. devalued. B. overvalued. C. revalued. D. undervalued.