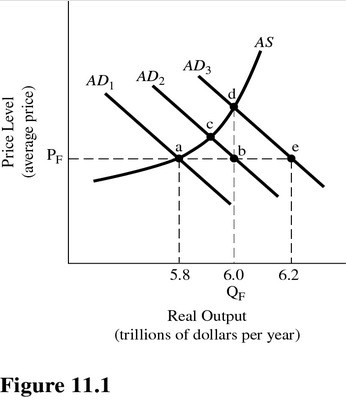

Refer to Figure 11.1. Assume aggregate demand is represented by AD1 and full-employment output is $6.0 trillion. The economy confronts a real GDP gap of

Refer to Figure 11.1. Assume aggregate demand is represented by AD1 and full-employment output is $6.0 trillion. The economy confronts a real GDP gap of

A. $.2 trillion.

B. $.6 trillion.

C. $.4 trillion.

D. None of the choices are correct.

Answer: A

You might also like to view...

When a Clarke tax is used to finance a public good, each person's tax equals

a. the amount that he is willing to pay for the good. b. the difference between the value he places on the public good and its cost. c. the cost of the public good minus the value that other people claim to receive from it. d. everyone else's tax, with the sum equaling the cost of producing the public good.

The law of one price states that

A) most countries require that all entering goods have the same price. B) most countries require that all exported goods have the same price. C) identical goods should have the same price anywhere in the world. D) most countries require that the price of a good not be changed once it is already in a store and available for sale.

Suppose technological improvements reduced the cost of producing automobiles by 50 percent, causing the price of automobiles to decline by a similar amount. Which of the following would necessarily result from this development?

a. Employment in the automobile industry would decrease. b. Real income would increase. c. Real income would decrease. d. Both a and c are correct.

Suppose the U.S. inflation rate falls while the inflation rate among the members of the European Monetary Union (EMU) holds constant. Other things equal, what will happen in the balance of payments accounts?

What will be an ideal response?