The government uses some of the tax money it collects from individuals and businesses to support public welfare programs. What is the benefit of these welfare programs to businesses in a private enterprise economy?

A. Recipients don't have to work.

B. Businesses must budget more money for taxes.

C. Funds received by recipients are spent in businesses.

D. Government has control of how the recipients spend their money.

C. Funds received by recipients are spent in businesses.

You might also like to view...

Which of the following is a defining characteristic of a perfectly competitive market?

A) advertisements by well-known celebrities B) persistent economic profits in the long run C) no restrictions on entry into the industry D) higher prices being charged for certain name brands

Between 1960 and 1973 the poverty rate ___; between 1973 and 1983 the poverty rate ___.

A. rose; rose B. fell; fell C. rose; fell D. fell; rose

The total amount of tax you pay divided by your total income is the

A. total tax rate. B. proportional tax rate. C. marginal tax rate. D. average tax rate.

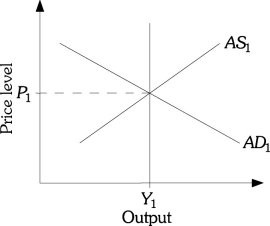

Refer to the information provided in Figure 32.2 below to answer the question(s) that follow. Figure 32.2Refer to Figure 32.2. According to ________ economists, under rational expectations an expected decrease in government spending would not change AD or AS.

Figure 32.2Refer to Figure 32.2. According to ________ economists, under rational expectations an expected decrease in government spending would not change AD or AS.

A. Keynesian B. the new classical C. monetarist D. none of the above