For this question, assume that investment spending depends only on output and no longer depends on the interest rate. Given this information, an increase in the money supply

A) will cause investment to decrease.

B) will cause investment to increase.

C) will cause a reduction in the interest rate.

D) will have no effect on output or the interest rate.

E) will cause an increase in output and have no effect on the interest rate.

C

You might also like to view...

Which of the following helps to explain the high savings rate in Singapore?

A) employer contributions for workers under the age of 50 B) the lack of a Social Security system like the one in the United States C) government policy D) all of the above

The CPI was 220 in 2012 and 231 in 2013 . Phil borrowed money in 2012 and repaid the loan in 2013 . If the nominal interest rate on the loan was 10 percent, then the real interest rate was

a. -5 percent. b. -1 percent. c. 5 percent. d. 3.2 percent.

Which of the following has the longest lag time for the Federal Reserve?

a. reducing production output b. increasing employment c. reducing government bonds d. increasing full price levels

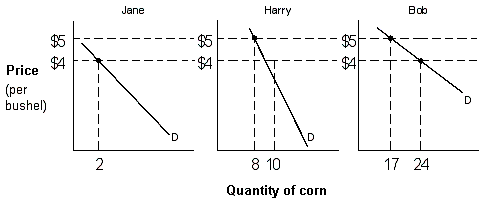

Exhibit 3-1 Market Demand

A. 3. B. 25. C. 17. D. 26.